Usda loan how much can i borrow

Buy homes in rural areas. In a typical scoring model your score generally ranges from a low of 300 to a high of 850.

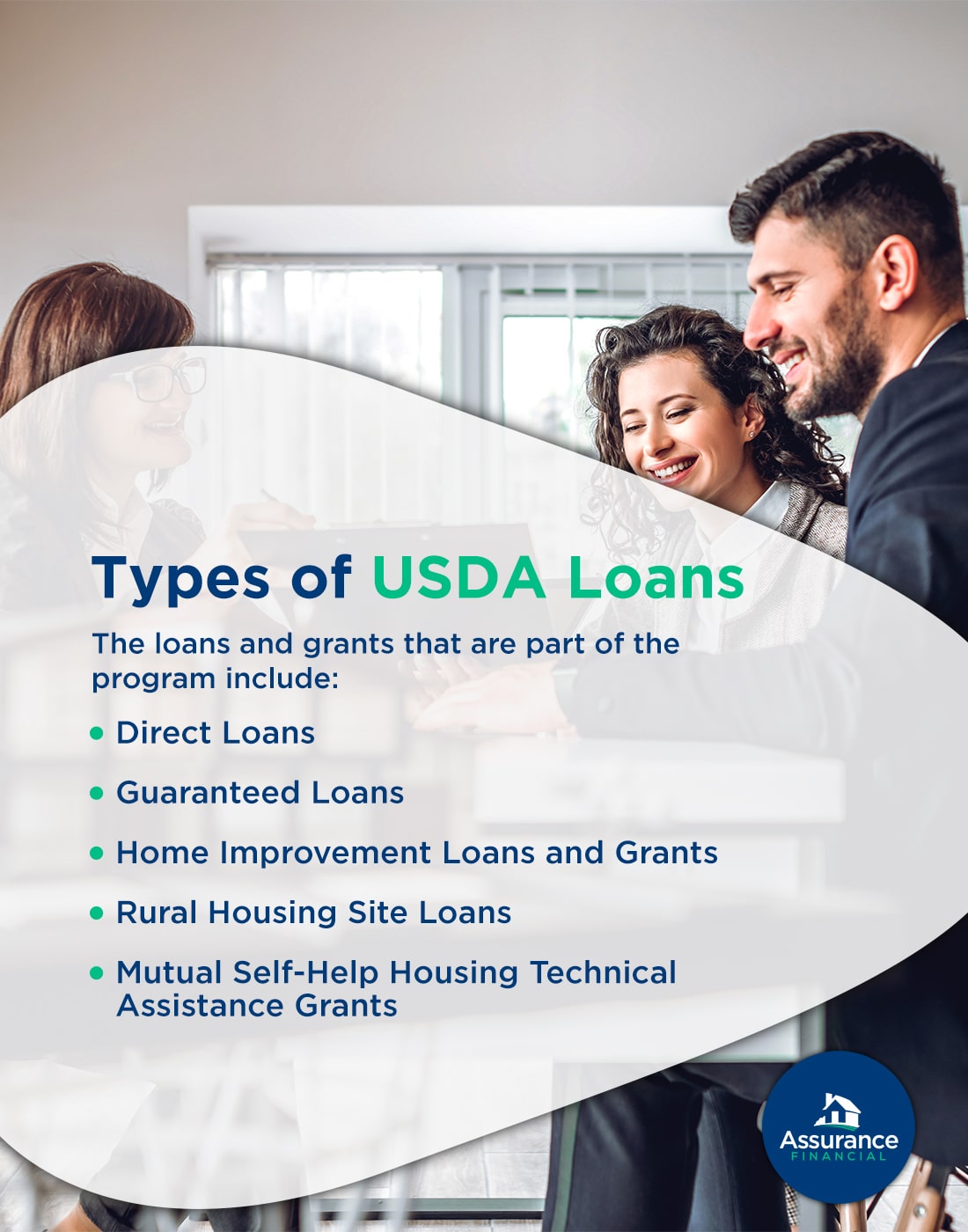

Fha Vs Usda Loans What S The Difference Assurance Financial

Even though USDA Direct Loans are underwritten by the USDA home buyers can still expect a 30-60 day timeline for loan approval.

. Federal Housing Administration FHA loans have a minimum down payment of 35. But if you need to borrow against your home equity note that USDA loans do not provide a cash-out option for refinances. Department of Agriculture USDA guarantees loans for some rural homes for up to 100-percent financing in other words theres no down payment requirement.

For example if you buy a home for 200000 and you have a 20 down payment youll bring 40000 to the table at closing. You can get a USDA loan with 0 down. A mortgage loan or simply mortgage ˈ m ɔːr ɡ ɪ dʒ in civil law jurisdicions known also as a hypothec loan is a loan used either by purchasers of real property to raise funds to buy real estate or by existing property owners to raise funds for any purpose while putting a lien on the property being mortgaged.

Both you and your home must. Sometimes known as loan term the length of the loan is the number of years until your home loan is paid in full. The operative word here is borrow or financeit.

See how much your monthly payment could be and find homes that fit your budget. If you are an applicant or an individual interested in learning more about the Single Family Housing Guaranteed Loan Program please visit our guaranteed housing webpage for further program information and guidance. USDA loans also have lower fees than other types of loans.

The maximum loan amount an applicant qualifies for depends on their ability to repay a loan. USDA home loans are zero down payment mortgages for eligible rural development zones backed by the US. If you are interested in applying for a guaranteed loan or have more specific questions not answered by the website please reach out to any of the programs.

Lenders usually calculate your down payment as a percentage of the total amount you borrow. For example you can get a conventional loan for as little as 3 down. Alterra - Fully online application mobile loan tracking borrow with nontraditional credit.

So theyre likely not best for. The time it takes for underwriting depends on where youre planning to purchase and how much backlog the USDA agency in that area has. The program is designed to make housing accessible and affordable in rural areas.

For a USDA loan you need to buy a house in a qualified rural area which usually means a population of 20000 or less and meet local income limits But the other two loan types. The loan is secured on the borrowers property through a process. Since 2010 20-year and 15-year.

The United States Department of Agriculture will guarantee your home loan but the entire process is handled through a local bank or lender. 15 of 78200 is equivalent to 11730 which we added to 78200 to obtain the 89930 income limit. The higher the credit score the better a borrower looks to potential lenders.

The application and. That means you can qualify for a USDA loan with an annual income of 89930 or less. How much can I borrow.

Total subsidized and unsubsidized loan limits over the course of your entire education include. Generally speaking most prospective homeowners can afford to finance a property whose mortgage is between two and two-and-a-half times their annual gross. Department of Veterans Affairs VA loans and United States Department of Agriculture USDA loans even allow eligible and qualified borrowers to put 0 down.

Expect a USDA loan to close in 30 45 days. A jumbo mortgage is a loan designed for a borrower who needs to finance a loan balance greater than conforming loan lending limits. The 2022 standard USDA loan income limit for 1-4 member households is 103500 and 136600 for 5-8 member households though limits can vary by location.

Like a traditional USDA loan home buyers borrow from a traditional lender and the USDA backs the loanThe difference between the two is that while a typical USDA loan allows a. USDA loan The US. Other mortgage programs like the FHA loan and conventional loan can have rates around 05-075 higher than USDA rates on average.

Funds can be used to build repair renovate or relocate a home or to purchase and prepare sites including providing water and waste treatment equipment. An FHA loan can An FHA loan can also take 30 to 45 days to close depending on the application process and how long underwriting takes. Find out how much house you can afford with our home affordability calculator.

Speak with a Neighbors Bank home loan specialist today to get started. A USDA construction loan is a mortgage that is guaranteed by the US. Heres what you need to know.

FHA loans are generally intended for home buyers with lower credit starting at 580. The USDA loan application can be started online or in-person and takes about 30-45 days from prequalification to closing and approval for homebuyers. The USDA home loan process isnt much different than a traditional mortgage program.

How much youd like. During this stage your lender will determine how much you can actually borrow by verifying income information and determining your debt-to-income DTI ratio which shows how much of your monthly income is going towards expenses. Department of Agriculture USDA.

This loan type is specifically designed for families looking to buy homes in rural areas. The program is known as the Rural Housing Loan or simply USDA loan The good news about the USDA Rural Housing Loan is that its not just a rural loan its available to. And mortgage insurance is cheaper for a USDA loan than an FHA loan.

How Much of a Mortgage Can I Afford. Check your USDA eligibility USDA loans are the best-kept secret in. Fairway - Online.

In other words if you meet the above USDA requirements you can likely borrow as much as a lender will give you. Most mortgages have a loan term of 30 years. Rural Development considers various factors.

Your credit score is a number that represents a snapshot of your credit history that lenders use to help determine how likely you are to repay a loan in the future. What if I can pay 20 down. That said mortgage rates are personal.

Borrowers can typically expect the USDA loan process to take anywhere from 30 to 60 days depending on the. Similar to the FHA loan this home loan lets lower-income families become. 31000 23000 subsidized 7000 unsubsidized Independent.

Louisville Kentucky Mortgage Lender For Fha Va Khc Usda And Rural Housing Kentucky Mortgages Kentucky Usda Rural Housing Loans Information Video

Fha Vs Usda Loans What S The Difference Assurance Financial

Usda Loan In Hawaii Hawaii Mortgage Experts

Usda Loan Payment Calculator Calculate Loan Guarantee Eligibility Closing Costs How Much You Can Afford To Borrow

Usda Loan Payment Calculator Calculate Loan Guarantee Eligibility Closing Costs How Much You Can Afford To Borrow

Usda Loan Payment Calculator Calculate Loan Guarantee Eligibility Closing Costs How Much You Can Afford To Borrow

Usda Mortgage Loan Lenders In Pa Md Requirements Rates

What Are Usda Loan Limits

What Is A Usda Loan And How Do I Apply

Conventional Loan Vs Usda Loan Comparing Loan Programs

Usda Home Loans What You Need To Know

Rural Development Home Loan Advantage Rcb Bank

Fha Vs Usda Loans What S The Difference Assurance Financial

Usda Maryland Home Loans

What Is A Usda Loan And How Do I Apply

What Is A Usda Loan Eligibility Rates Advantages For 2020 Usda Loan Home Buying Checklist Fha Loans

Louisville Kentucky Mortgage Lender For Fha Va Khc Usda And Rural Housing Kentucky Mortgages Kentucky Usda Rural Housing Loans Information Video